Sign Up for the PSERS Video Series

Submit this form and gain immediate access!

As soon as you hit the Submit button, you'll be taken to Part 1 of the PSERS Video Series. We'll also email you a link to access the all 4 parts of the video series in case you'd like to access them at a later date.

P&G RETIREMENT INCOME PLANNING

Stone House Is An Independent Company And Is Not Affiliated With Or Endorsed By PSERS.

Be Confident in Your Retirement Income Plan

YOUR PUBLIC SCHOOL

RETIREMENT INCOME PLAN

You have several decisions to make as you prepare for retirement from the PA Public School System. We can help you make them confidently.

82

A GREAT PLACE TO START!

The Public School Employee Pre-Retirement Checklist

Designed for PA Public School Employees planning for retirement in the next 1-5 years, this Pre-Retirement Checklist will help you prepare for the transition into retirement with ease and peace of mind.

First Name:

Last Name:

Email Address:

Phone Number:

What School District Will You Be Retiring From?

As soon as you hit SUBMIT, you'll be taken to the downloadable Pre-Retirement Checklist: Public School Employee Edition PDF.

By submitting your mobile number, you agree to receive text messages from regarding your subscriptions or other industry related information. You can opt-out anytime. Message & data rates may apply. View Mobile Terms. View Privacy Policy.

Understand Your Pension Options

There are several pension options to choose from as you prepare for retirement from the PA Public School System. First, we'll help you understand those options and what they might mean for you and your loved ones.

Visualize the Future Based On Your Decisions Today

Using our Future You Analysis Tool, we'll create helpful, easy-to-understand graphs and charts to help you envision the costs and benefits of your pension options, based on your numbers, risk tolerance, and other key factors.

Develop a Retirement Income Plan to Last 30+ Years

Based on where you are today and what you'd like your retirement to be like, we'll help you develop a retirement income plan you can feel confident in.

Eager to get started? Click here to speak with a Stone House Advisor.

Want to Speak with a Stone House Advisor Now?

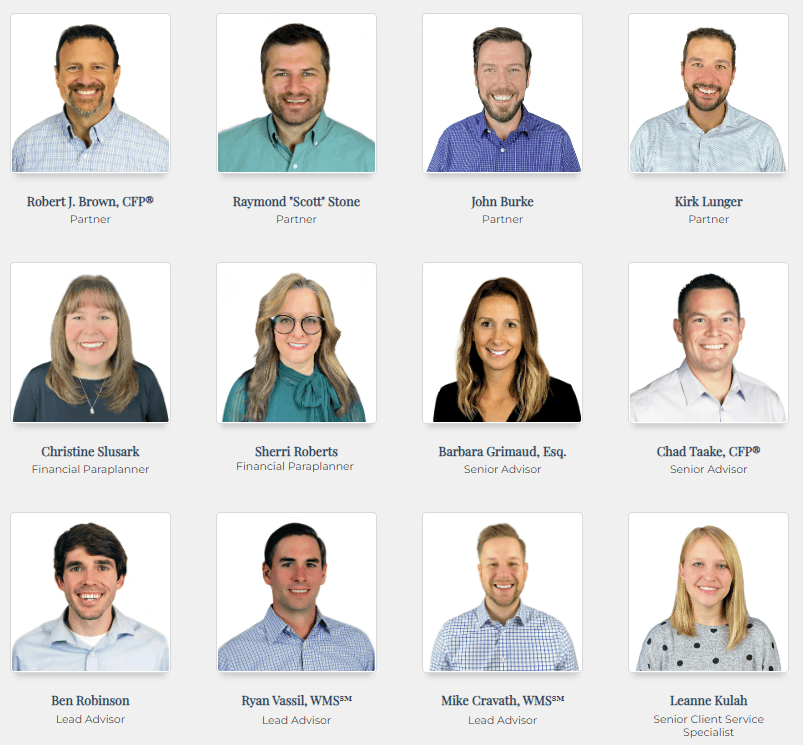

Meet the Stone House Team

Decades of combined experience in helping people enjoy retirement and reach financial freedom.

Robert J. Brown, CFP®

Partner

Raymond "Scott" Stone

Partner

John Burke

Partner

Kirk Lunger

Partner

Christine Slusark

Financial Paraplanner

Sherri Roberts

Financial Paraplanner

Barbara Grimaud, Esq.

Senior Advisor

Chad Taake, CFP®

Senior Advisor

Ben Robinson

Lead Advisor

Ryan Vassil, WMS℠

Lead Advisor

Mike Cravath, WMS℠

Lead Advisor

Leanne Kulah

Senior Client Service Specialist

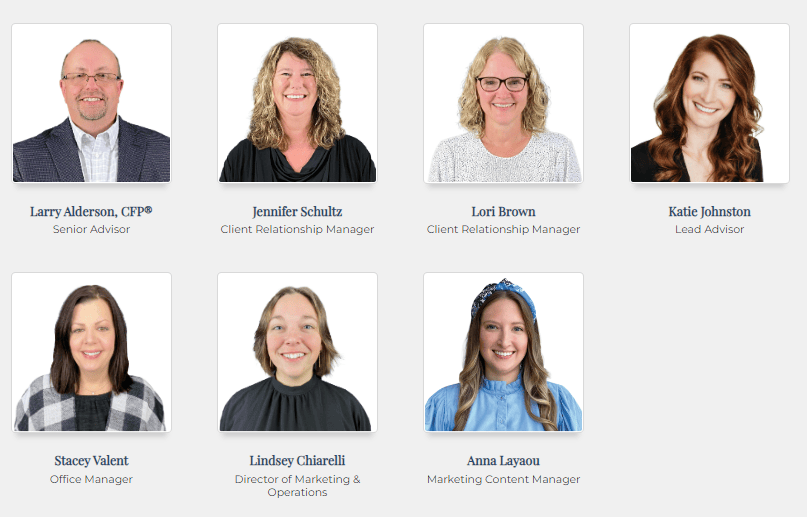

Larry Alderson, CFP®

Senior Advisor

Jennifer Schultz

Client Relationship Manager

Lori Brown

Client Relationship Manager

Katie Johnston

Lead Advisor

Stacey Valent

Office Manager

Lindsey Chiarelli

Director of Marketing & Operations

Anna Layaou

Marketing Content Manager

Our Greatest Teachers Are Our Clients

The entire team at Stone House knows that listening is the key to earning trust, developing relationships and achieving measurable success for our clients.

We are guided by the same values that our clients live by; hard work, integrity and fairness. Using these values, we have built a business that tries to make a positive difference in the lives of those we serve. Seeing these results continues to build our passion for what we do. As the needs of our clients change, we continue to listen, to grow and evolve in order to provide the best financial and investment advice possible.

Robert J. Brown, CFP® - Partner

Bob began his career with a large financial services company, where he was educated in fundamental financial planning concepts. During that time period, he became registered as a Certified Financial Planner TM professional. For several years, he worked through an independent Broker/Dealer to allow his clients more freedom, flexibility and choice of investments. Bob has worked with hundreds of clients by helping them plan for their goals and establish appropriate allocations within their portfolios. He has dedicated countless hours to volunteer work revolving around his kids’ activities and his community. He continues to serve as an active board member of the Community Foundation of the Endless Mountains as well as the Wyoming County United Way. Admittedly, his weakness is that outside of the office Bob still believes he is 25 years old and that we’re all still living in the 80’s.

Raymond "Scott" Stone - Partner

Raymond Stone, who most of us know by his middle name "Scott", is one of our founding partners. Scott handles much of the operations and regulatory compliance issues that face Stone House on a daily basis. From technology to policies and procedures to ensuring compliance with government regulations, Scott helps keep Stone House running in peak condition. Scott also advises a select group of clients and is part of our investment management committee. He enjoys tackling tough challenges and creating solutions to difficult problems. Over the years Scott has been involved with several community organizations such as Kiwanis, the Wyoming County Cultural Society, and the Montrose Chamber of Commerce. He enjoys traveling and spending time with his family and friends.

John Burke - Partner

John joined Stone House as an Investment Advisor Representative. He previously worked for Procter & Gamble for fourteen years. During his time with P&G, he had roles doing Supply Chain, Operations & Initiative Management. John’s work in investments and financial planning started while at the University of Notre Dame where he earned a MBA degree. Since then, he has managed his own portfolios using mixes of quantitative, fundamental and technical strategies. In 2002, John also started up a successful small business. John became a partner in Stone House in 2015.

Kirk Lunger - Partner

Kirk joined the team at Stone House Investment Management, LLC as an Investment Advisor Representative in 2014. He began his financial career as an accountant at Northeast Concepts, Inc. in Dallas, PA. He has always been passionate about the inner-workings of finance, business and investing, since earning a BS in Accounting from Misericordia University. As a financial advisor he loves being able to communicate those passions to his clients by guiding them through unfamiliar terrain. Kirk concentrates heavily on helping families navigate the complex retirement process; ensuring the best strategies are established to protect a client’s assets and income up to and throughout retirement. In his spare time, he loves spending his out-of-office hours on the golf course, in the outdoors, but most of all spending time with his family. It’s of utmost importance to him that he offers his clients well-informed and knowledgeable assistance in reaching their financial goals and objectives.

Christine Slusark - Financial Paraplanner

Christine earned her Bachelor of Science in Business Management from Lock Haven University in 1998. After graduating, she spent time working for a major insurance company where she earned licenses to offer Life, Health and Accident Insurance as well as securities. Christine is not only well educated in the insurance arena, but has spent numerous years in the financial advising industry. She worked as a Paraplanner in a very successful practice for a major financial advising company for over 9 years. She played an integral part in the financial planning process working very closely with clients gathering data and analyzing information. She also has experience in asset management, portfolio rebalancing and securities trading. Christine joined the Stone House team in 2010 and we are all better for it!

Sherri Roberts - Financial Paraplanner

Sherri has a diverse professional background which includes customer service, healthcare, insurance and management. She has worked with major insurance companies as a licensed producer and as an Independent Agent. She has insurance licenses for Life, Health, Annuities and Property & Casualty. She brings a great deal of knowledge and experience as a qualified Financial Paraplanner.

In her personal time, she enjoys traveling and spending time with her family and friends. Her favorite adventure is traveling to the lovely beaches of Aruba.

Barbara Grimaud, Esq. - Senior Advisor

Barbara joined Stone House Investment Management in 2018. After attending the U.S. Naval Academy, Barbara served 5 years as a Supply Officer in the U.S. Navy. She then attended Widener University School of Law and became licensed to practice law in Pennsylvania in 2013. Barbara clerked for federal District Judge Edwin Kosik of the Middle District of Pennsylvania for 3 years. Barbara joins our team eager to work one-on-one with clients as they navigate through various aspects of their life that Stone House addresses in their Life Stack approach. Barbara looks forward to alleviating the burden of financial planning as clients prepare for their future and the future of their estates. In her spare time, you can find Barbara still practicing law, volunteering in various community groups such as the American Legion, Rotary, and the Tewksbury Committee, as well as spending time with her family, horseback riding, and snowmobiling.

Chad Taake - Senior Advisor

Chad Taake joined Stone House Investment Management, LLC as an Investment Advisor Representative in 2018. Thanks to his work ethic, he continues to work for Procter & Gamble as well. At P&G, he has had roles doing Material Development, Operations, Engineering, & Initiative Management. Chad's passion for investments started as a child, investing with his father. In college, he continued his financial learning earning a Masters in Engineering Management at the University of Missouri Rolla. When not working, Chad is often at one of the city parks with his 2 kids.

Leanne Kulah - Senior Client Service Specialist

Leanne joined the Stone House team in 2018. She earned her Bachelor of Science Degree from Lock Haven University in 2009 and went on to earn a Master of Science Degree from Binghamton University in 2012 (Go Bearcats)! Leanne has a varied professional background that includes extensive customer service experience. She looks forward to putting that knowledge to good use while also learning more about the financial industry and helping clients. In her spare time, she enjoys spending time with her husband and daughter and visiting family in Bradford County.

Ben Robinson - Lead Advisor

Ben joined the team as an Investment Advisor Representative in 2020. After graduating from Lock Haven University in 2016 with a major in Business Administration, Ben moved to Colorado and Utah for a few years to pursue his passion of running and starting a Nonprofit Organization. After moving back to his hometown of Tunkhannock, Ben became intrigued in the stock market and investments. He spent his free time studying market trends, technical analysis strategies, and historical data to build his own successful portfolio. When the opportunity at Stone House presented itself of combining his love of finance and helping people, it was the perfect fit. Outside of Stone House, Ben enjoys running the local mountains here in Wyoming County, traveling to the best mountain ranges in the US and Europe for trail races, and awesome adventures with his wife, Jill.

Ryan Vassil, Wealth Management Specialist℠ - Lead Advisor

Ryan Vassil is an adviser with Stone House. He grew up in NEPA, attending Abington Heights HS and recently moved back to the area. He had been previously working in Philadelphia for a tech consulting company that serviced clients like IBM, Dell, HP, and Cisco. He liked solving complex problems for his clients to achieve their company goals but always wanted to have a career in finance and help clients on a personal level. Ryan brings the skills he learned from living and working in Philadelphia along with his background studying financial economics in college to the Stone House team and ultimately to our future and existing clients. Ryan’s investing and money management skills were first developed in college while partaking in the business/ investing club and attending the Robert McCann Wall Street leadership conferences. His main goal at Stone House is to use his passion for finance and investing to help families in the area retire with ease and comfort for many years after retirement. Ryan enjoys watching and playing sports in his free time and is probably playing golf on a sunny weekend.

Mike Cravath, Wealth Management Specialist℠ - Lead Advisor

Mike joined the Stonehouse team after spending the early part of his career with a large finance firm. He had always enjoyed learning about the intricacies of finance and solving complex issues which is what led him to graduating with a degree in accounting and minor in forensic accounting from Marywood University. He quickly found a passion for financial advising using his abilities to help others and make a positive impact in their lives. Mike prides himself on taking a wholistic approach to financial advising. He does this by navigating his clients through all aspects of their finances and supporting them through every stage of life. Mike decided to come to Stone House because of their commitment to exceeding client expectations. In his spare time, Mike enjoys golfing, spending time with family and friends, and going on adventures with his Golden Retriever, Walter.

Katie Johnston - Lead Advisor

Katie earned her Bachelor of Science in Finance from King’s College in 2010. While studying at King’s , Katie began working in the Oil & Gas Industry preparing title searches for various companies and continued this work after graduating for eight years until she found the opportunity to work for Global Tungsten & Powders in Towanda, PA as a Strategic Materials Purchasing Analyst. Her passion for helping people and education in Finance led Katie to pursue licensing as a Financial Advisor. Prior to joining Stone House in 2023, she started her financial advising career in 2020 and spent the last few years working for a local bank to help clients plan and manage their finances. Katie also holds her Life, Health and Annuity Insurance license to ensure a complete and holistic financial planning approach.

When not working, Katie enjoys spending time with her husband, two sons and their three spoiled dogs. Always an avid athlete, Katie loves to play volleyball at the Towanda YMCA, golf, and support her two sons in their athletic endeavors in soccer, basketball and golf.

Larry Alderson, CFP® - Senior Advisor

Having obtained his first financial oriented license in 1994, Larry is a local industry veteran with extensive knowledge and expertise in all facets of financial planning. In addition to working as a Trust Officer, he led various teams of financial delivery professionals for a local bank's wealth management division for 24 years.

Larry is an Honors Graduate of Cannon Financial Institute, Trust Schools 1, 2, & 3. He has also completed the College for Financial Planning Professional Education and the American Bankers Association Private Wealth Management School. In addition to holding the designation of both Certified Trust and Financial Advisor (CTFA) and Certified Financial Planner® practitioner (CFP®), he also holds Security Licenses Series 7 – General Securities Representative and Series 63 – Uniform Securities Agent, as well as Life, Accident, Health and Property Casualty Insurance Licenses. Larry served as a member of the Pennsylvania Bankers Association Advisory Committee on Financial Planning from 2002 through 2004.

Larry is known to be an active member of his community. He was appointed and/or elected to Pike Township Board of Supervisors from 1992 through 2011. He is Past President of Athens Rotary, a member of LeRay Lodge #471 F. & A.M., a member of the Financial Planning Association, and has been a member of the Finance and Investment Committee for the Community Foundation for the Twin Tiers since its inception in 2002.

Jennifer Schultz - Client Relationship Manager

With over two decades of experience in financial industry, Jennifer has spent her professional career helping clients manage investments, administer trusts and estates, as well as provide general financial planning advice. She brings her strong skillset to Stone House, where her wealth of knowledge and dedication to client success will contribute to the team's overall expertise and commitment to providing comprehensive financial solutions. She received her Bachelor’s Degree in Nutrition and Dietetics from Mansfield University, and received certifications from PBA Trust School at Bucknell University and Cannon Financial Institute Trust School 1, 2 and 3. She also maintains her Life Accident and Health insurance license. Jennifer serves as a Trustee for the Northeast Bradford Education Foundation. In her free time, she enjoys summers at the lake, the outdoors, cooking, music and spending time with her husband, Bob, and their children.

Lori Brown - Client Relationship Manager

Lori has worked in the financial services industry for over 35 years. Over her extensive career, she has completed the Cannon Trust School and many banking courses. She has experienced many facets of the business and has a passion for going the extra mile for her clients. Stone House became a good fit for her in 2023, and she assumed the role of Client Relationship Manager. Being raised on a farm in Bradford County, Lori enjoys being home and working outside. She can often be found walking her dog on a back country road, enjoying the fresh air or just hanging out with family. Lori is a long-time member of the Towanda Rotary Club and is on the Board at The Main Link.

Stacey Valent - Office Manager

Stacey joined Stone House team in 2023 as office manager. She grew up in Clarks Summit, PA and graduated from Abington Heights in 1990 before earning an Associate's Degree in Business at Keystone College. She moved to Georgia, the Poconos, and Florida before moving back home to Clarks Summit, PA in 2002. She has a professional background that includes customer service, administration, and running her own bakery. Stacey is excited to help clients, learn more about financial planning, and become part of a team. Outside of Stone House, she resides in Tunkhannock and enjoys spending time with her husband Rick, daughter Kati, as well as their cats and dogs (Labs), She loves traveling and spending time in the Finger Lakes with her husband. Her hobbies are running, baking, and cake decorating.

Lindsey Chiarelli - Director of Marketing & Operations

As the Director of Marketing and Operations, Lindsey uses an innovative and strategic mindset in building Stone House's branding and business processes. She is a proud graduate of Marywood University, where she earned her Masters in Communication Arts in 2017, specializing in media production and management. Her academic and career experience has provided her with a comprehensive understanding of effective communication strategies and media dynamics, which she leverages to bring together the team's goals internally and externally. On weekends, you'll often find Lindsey knitting, gardening, or spending time with her family.

Anna Layaou - Marketing Content Manager

Anna Layaou is a dynamic marketing professional who graduated from the University of Scranton in 2018. Her post-graduation journey has been marked by her versatile expertise in the realms of PR/events, digital marketing, and email marketing. With a passion for creating impactful connections, Anna's strategic skills and creative flair have consistently propelled her to excel in devising and executing innovative marketing campaigns that leave a lasting impression. Her dedication to mastering diverse facets of the marketing landscape has made her a valuable asset in driving brand growth and engagement. When not working, Anna loves to travel, run around her neighborhood, and spend time with family and friends.

Lindsey Chiarelli - Director of Marketing

Lindsey earned a master’s degree in communication arts from Marywood University in 2017 with a focus in media management and production. She has a background in advertising and public relations with experience in digital marketing, and she uses her skills to broaden Stone House’s client communication and branding. Lindsey has roots in Tunkhannock – graduating from the local high school – but she now resides in Exeter with her husband, Sam, and their dog, Gus. In her spare time, Lindsey enjoys hiking, gardening, knitting, or curling up with a good book.

Stone House Medicare Insurance Advisors

Stephanie Holdt - Medicare Insurance Advisor

Stephanie Joined us in 2019 to focus on retiree health insurance planning. Retiree health insurance can be very confusing and expensive. There are great tools and tips available to minimize cost and maximize benefits for retirees when they are shopping for health insurance. Stephanie is an expert at navigating the health insurance markets to find savings and benefits for her clients. Stephanie is a licensed health insurance agent in Pennsylvania and advises retirees on Individual Health Insurance, Medicare Supplement, Medicare Advantage, and Prescription Drug Plans. She can also help find coupons and deals on prescription drugs and grants to save clients money on health care. Her hobbies include marathons, skiing, kayaking, riding quads and just about any activity out doors and with her family. She has a personal goal of running a half marathon in under 2 hours. She was born and raised in Michigan where she got her BSBA degree from Central Michigan University. She is a Certified National Social Security Adviser and genuinely loves educating individuals on how to choose the best health insurance to fit their needs.

Stone House Tax, Business and Municipal Accounting

Jennifer Smith-Crary - Tax and Business Consultant

Numbers have always been Jennifer's thing, and math was always her favorite subject in school. With a Mom who worked in banking, she found a spark of interest and took accounting classes as early as high school. Jennifer has been working in accounting since 1999, and continues her journey today with Stone House Tax, Business and Municipal Accounting. Her favorite part is helping clients make all the pieces fit together like making sure no expense is missed in bookkeeping or being sure a tax return is accurate. Ultimately, she enjoys taking the burden off of her clients' shoulders knowing the details and paperwork will be taken care of, and she fits in well with the team with a positive and adventurous outlook. Jennifer has been a lifetime resident of Tunkhannock and enjoys spending time with her husband, children and family. During the tax off-season, gardening or "dirt therapy" is her stress relief.

Diana Patton - Business and Municipal Consultant

Ben DeNault, CPA - Accounting Consultant

Ben is a Wyalusing local who graduated from Wyalusing Valley High School in 2010. He then went on to receive his bachelor’s degree in accounting and business management with minors in economics and finance from the University of Pittsburgh at Bradford. After college Ben began working for Thompson Morgan and Company in Towanda. He obtained his CPA license in 2016 and became partner in 2017. After the passing of Tom Thompson Ben purchased and renamed the firm with his partner Bill Carmalt which opened his current firm Carmalt, DeNault & Thompson PC.

Samantha Hayward - Business and Municipal Consultant

Samantha has 25 years in customer service industry and in those years she brings with her 15 years of banking experience. She worked with patients at a local top Dental office. Helping them to ease their anxiety and work thru their financial responsibility. Samantha has worked in both a large bank and a small neighborhood bank and still has bonds that she has made from all her experiences. Her favorite part of her work experience is knowing that she helped someone through a tough time. She likes to learn and excels in working with numbers. Prior to starting at Stone House Tax Business and Municipal Accounting, she worked with a local bank here in Tunkhannock. She grew up and graduated from Tunkhannock and still lives here with her husband, Scott. Her daughter Megan, just graduated from Kutztown University and her daughter Macey is currently a student at Finger Lakes Community College. In her spare time, she loves photography and scary movies. Samantha and her husband spend as much time together as they can, they love to fish, hike and bike in the beautiful surrounding trails, go to baseball games. Each summer they love to spend their vacation in the Outer Banks, NC.

Lynne Binner - Business and Municipal Consultant

Lynne joined Stone House Tax, Business & Municipal Accounting in 2021. She has lived in the Tunkhannock area for most of her life and is a graduate of Gettysburg College with a B.A. in Business Management with concentrations in Accounting/Finance and Entrepreneurship. After graduating from college, she worked as a senior accountant for a large regional public accounting firm for 6 years. Lynne then worked as the controller for a water company for 9 years and also did accounting work for companies as a subcontractor until she began homeschooling her 3 children 14 years ago. In addition to homeschooling her youngest child, Lynne is the varsity girls volleyball coach at Tunkhannock Area High School and enjoys spending time with her family, playing volleyball, and volunteering at her church. Lynne is a recipient of two cochlear implants and is very grateful for the gift of hearing!

Christina Kaleta - Office Manager

Christina has over 25 years experience in the customer service industry. She has worked for large corporations, as well as small businesses. Prior to starting with Stone House, she had worked for a local insurance company for over 18 years maintaining customer service and lasting relationships with clients. She is dedicated to providing an excellent client experience within our Medicare office. Christina currently lives in Tunkhannock with her husband Eric, daughter Abby who is a college student at University at Albany, her son Matthew who is a student at Tunkhannock Area school district, and two dogs Riley and Milo. In her spare time, Christina enjoys cooking, watching her son play baseball, and spending time with family and friends.

Samantha Hayward - Business and Municipal Consultant

Lynne Binner - Business and Municipal Consultant

Our Greatest Teachers Are Our Clients

The entire team at Stone House knows that listening is the key to earning trust, developing relationships and achieving measurable success for our clients.

We are guided by the same values that our clients live by; hard work, integrity and fairness. Using these values, we have built a business that tries to make a positive difference in the lives of those we serve. Seeing these results continues to build our passion for what we do. As the needs of our clients change, we continue to listen, to grow and evolve in order to provide the best financial and investment advice possible.

Robert J. Brown, CFP® - Partner

Bob began his career with a large financial services company, where he was educated in fundamental financial planning concepts. During that time period, he became registered as a Certified Financial Planner TM professional. For several years, he worked through an independent Broker/Dealer to allow his clients more freedom, flexibility and choice of investments. Bob has worked with hundreds of clients by helping them plan for their goals and establish appropriate allocations within their portfolios. He has dedicated countless hours to volunteer work revolving around his kids’ activities and his community. He continues to serve as an active board member of the Community Foundation of the Endless Mountains as well as the Wyoming County United Way. Admittedly, his weakness is that outside of the office Bob still believes he is 25 years old and that we’re all still living in the 80’s.

Raymond "Scott" Stone - Partner

Raymond Stone, who most of us know by his middle name "Scott", is one of our founding partners. Scott handles much of the operations and regulatory compliance issues that face Stone House on a daily basis. From technology to policies and procedures to ensuring compliance with government regulations, Scott helps keep Stone House running in peak condition. Scott also advises a select group of clients and is part of our investment management committee. He enjoys tackling tough challenges and creating solutions to difficult problems. Over the years Scott has been involved with several community organizations such as Kiwanis, the Wyoming County Cultural Society, and the Montrose Chamber of Commerce. He enjoys traveling and spending time with his family and friends.

John Burke - Partner

John joined Stone House as an Investment Advisor Representative. He previously worked for Procter & Gamble for fourteen years. During his time with P&G, he had roles doing Supply Chain, Operations & Initiative Management. John’s work in investments and financial planning started while at the University of Notre Dame where he earned a MBA degree. Since then, he has managed his own portfolios using mixes of quantitative, fundamental and technical strategies. In 2002, John also started up a successful small business. John became a partner in Stone House in 2015.

Kirk Lunger - Senior Advisor

Kirk joined the team at Stone House Investment Management, LLC as an Investment Advisor Representative in 2014. He began his financial career as an accountant at Northeast Concepts, Inc. in Dallas, PA. He has always been passionate about the inner-workings of finance, business and investing, since earning a BS in Accounting from Misericordia University. As a financial advisor he loves being able to communicate those passions to his clients by guiding them through unfamiliar terrain. Kirk concentrates heavily on helping families navigate the complex retirement process; ensuring the best strategies are established to protect a client’s assets and income up to and throughout retirement. In his spare time, he loves spending his out-of-office hours on the golf course, in the outdoors, but most of all spending time with his family. It’s of utmost importance to him that he offers his clients well-informed and knowledgeable assistance in reaching their financial goals and objectives.

Christine Slusark - Financial Paraplanner

Christine earned her Bachelor of Science in Business Management from Lock Haven University in 1998. After graduating, she spent time working for a major insurance company where she earned licenses to offer Life, Health and Accident Insurance as well as securities. Christine is not only well educated in the insurance arena, but has spent numerous years in the financial advising industry. She worked as a Paraplanner in a very successful practice for a major financial advising company for over 9 years. She played an integral part in the financial planning process working very closely with clients gathering data and analyzing information. She also has experience in asset management, portfolio rebalancing and securities trading. Christine joined the Stone House team in 2010 and we are all better for it!

Sherri Roberts - Financial Paraplanner Qualified Professional™

Sherri has a diverse professional background which includes customer service, healthcare, insurance and management. She has worked with major insurance companies as a licensed producer and as an Independent Agent. She has insurance licenses for Life, Health, Annuities and Property & Casualty. She brings a great deal of knowledge and experience as a qualified Financial Paraplanner.

In her personal time, she enjoys traveling and spending time with her family and friends. Her favorite adventure is traveling to the lovely beaches of Aruba.

Barbara Grimaud, Esq. - Lead Advisor

Barbara joined Stone House Investment Management in 2018. After attending the U.S. Naval Academy, Barbara served 5 years as a Supply Officer in the U.S. Navy. She then attended Widener University School of Law and became licensed to practice law in Pennsylvania in 2013. Barbara clerked for federal District Judge Edwin Kosik of the Middle District of Pennsylvania for 3 years. Barbara joins our team eager to work one-on-one with clients as they navigate through various aspects of their life that Stone House addresses in their Life Stack approach. Barbara looks forward to alleviating the burden of financial planning as clients prepare for their future and the future of their estates. In her spare time, you can find Barbara still practicing law, volunteering in various community groups such as the American Legion, Rotary, and the Tewksbury Committee, as well as spending time with her family, horseback riding, and snowmobiling.

Chad Taake - Lead Advisor

Chad Taake joined Stone House Investment Management, LLC as an Investment Advisor Representative in 2018. Thanks to his work ethic, he continues to work for Procter & Gamble as well. At P&G, he has had roles doing Material Development, Operations, Engineering, & Initiative Management. Chad's passion for investments started as a child, investing with his father. In college, he continued his financial learning earning a Masters in Engineering Management at the University of Missouri Rolla. When not working, Chad is often at one of the city parks with his 2 kids.

Leanne Kulah - Office Manager

Leanne joined the Stone House team in 2018. She earned her Bachelor of Science Degree from Lock Haven University in 2009 and went on to earn a Master of Science Degree from Binghamton University in 2012 (Go Bearcats)! Leanne has a varied professional background that includes extensive customer service experience. She looks forward to putting that knowledge to good use while also learning more about the financial industry and helping clients. In her spare time, she enjoys spending time with her husband and daughter and visiting family in Bradford County.

Ben Robinson, Wealth Management Specialist℠ - Advisor

Ben joined the team as an Investment Advisor Representative in 2020. After graduating from Lock Haven University in 2016 with a major in Business Administration, Ben moved to Colorado and Utah for a few years to pursue his passion of running and starting a Nonprofit Organization. After moving back to his hometown of Tunkhannock, Ben became intrigued in the stock market and investments. He spent his free time studying market trends, technical analysis strategies, and historical data to build his own successful portfolio. When the opportunity at Stone House presented itself of combining his love of finance and helping people, it was the perfect fit. Outside of Stone House, Ben enjoys running the local mountains here in Wyoming County, traveling to the best mountain ranges in the US and Europe for trail races, and awesome adventures with his wife, Jill.

Ryan Vassil, Wealth Management Specialist℠ - Advisor

Ryan Vassil is an adviser with Stone House. He grew up in NEPA, attending Abington Heights HS and recently moved back to the area. He had been previously working in Philadelphia for a tech consulting company that serviced clients like IBM, Dell, HP, and Cisco. He liked solving complex problems for his clients to achieve their company goals but always wanted to have a career in finance and help clients on a personal level. Ryan brings the skills he learned from living and working in Philadelphia along with his background studying financial economics in college to the Stone House team and ultimately to our future and existing clients. Ryan’s investing and money management skills were first developed in college while partaking in the business/ investing club and attending the Robert McCann Wall Street leadership conferences. His main goal at Stone House is to use his passion for finance and investing to help families in the area retire with ease and comfort for many years after retirement. Ryan enjoys watching and playing sports in his free time and is probably playing golf on a sunny weekend.

Mike Cravath, Wealth Management Specialist℠ - Advisor

Mike joined the Stonehouse team after spending the early part of his career with a large finance firm. He had always enjoyed learning about the intricacies of finance and solving complex issues which is what led him to graduating with a degree in accounting and minor in forensic accounting from Marywood University. He quickly found a passion for financial advising using his abilities to help others and make a positive impact in their lives. Mike prides himself on taking a wholistic approach to financial advising. He does this by navigating his clients through all aspects of their finances and supporting them through every stage of life. Mike decided to come to Stone House because of their commitment to exceeding client expectations. In his spare time, Mike enjoys golfing, spending time with family and friends, and going on adventures with his Golden Retriever, Walter.

Lindsey Chiarelli - Director of Marketing

Lindsey earned a master’s degree in communication arts from Marywood University in 2017 with a focus in media management and production. She has a background in advertising and public relations with experience in digital marketing, and she uses her skills to broaden Stone House’s client communication and branding. Lindsey has roots in Tunkhannock – graduating from the local high school – but she now resides in Exeter with her husband, Sam, and their dog, Gus. In her spare time, Lindsey enjoys hiking, gardening, knitting, or curling up with a good book.

Stone House Medicare Insurance Advisors

Stephanie Holdt - Medicare Insurance Advisor

Stephanie Joined us in 2019 to focus on retiree health insurance planning. Retiree health insurance can be very confusing and expensive. There are great tools and tips available to minimize cost and maximize benefits for retirees when they are shopping for health insurance. Stephanie is an expert at navigating the health insurance markets to find savings and benefits for her clients. Stephanie is a licensed health insurance agent in Pennsylvania and advises retirees on Individual Health Insurance, Medicare Supplement, Medicare Advantage, and Prescription Drug Plans. She can also help find coupons and deals on prescription drugs and grants to save clients money on health care. Her hobbies include marathons, skiing, kayaking, riding quads and just about any activity out doors and with her family. She has a personal goal of running a half marathon in under 2 hours. She was born and raised in Michigan where she got her BSBA degree from Central Michigan University. She is a Certified National Social Security Adviser and genuinely loves educating individuals on how to choose the best health insurance to fit their needs.

Stone House Tax, Business and Municipal Accounting

Jennifer Smith-Crary - Tax and Business Consultant

Numbers have always been Jennifer's thing, and math was always her favorite subject in school. With a Mom who worked in banking, she found a spark of interest and took accounting classes as early as high school. Jennifer has been working in accounting since 1999, and continues her journey today with Stone House Tax, Business and Municipal Accounting. Her favorite part is helping clients make all the pieces fit together like making sure no expense is missed in bookkeeping or being sure a tax return is accurate. Ultimately, she enjoys taking the burden off of her clients' shoulders knowing the details and paperwork will be taken care of, and she fits in well with the team with a positive and adventurous outlook. Jennifer has been a lifetime resident of Tunkhannock and enjoys spending time with her husband, children and family. During the tax off-season, gardening or "dirt therapy" is her stress relief.

Diana Patton - Business and Municipal Consultant

Ben DeNault, CPA - Accounting Consultant

Ben is a Wyalusing local who graduated from Wyalusing Valley High School in 2010. He then went on to receive his bachelor’s degree in accounting and business management with minors in economics and finance from the University of Pittsburgh at Bradford. After college Ben began working for Thompson Morgan and Company in Towanda. He obtained his CPA license in 2016 and became partner in 2017. After the passing of Tom Thompson Ben purchased and renamed the firm with his partner Bill Carmalt which opened his current firm Carmalt, DeNault & Thompson PC.

Samantha Hayward - Business and Municipal Consultant

Samantha has 25 years in customer service industry and in those years she brings with her 15 years of banking experience. She worked with patients at a local top Dental office. Helping them to ease their anxiety and work thru their financial responsibility. Samantha has worked in both a large bank and a small neighborhood bank and still has bonds that she has made from all her experiences. Her favorite part of her work experience is knowing that she helped someone through a tough time. She likes to learn and excels in working with numbers. Prior to starting at Stone House Tax Business and Municipal Accounting, she worked with a local bank here in Tunkhannock. She grew up and graduated from Tunkhannock and still lives here with her husband, Scott. Her daughter Megan, just graduated from Kutztown University and her daughter Macey is currently a student at Finger Lakes Community College. In her spare time, she loves photography and scary movies. Samantha and her husband spend as much time together as they can, they love to fish, hike and bike in the beautiful surrounding trails, go to baseball games. Each summer they love to spend their vacation in the Outer Banks, NC.

Lynne Binner - Business and Municipal Consultant

Lynne joined Stone House Tax, Business & Municipal Accounting in 2021. She has lived in the Tunkhannock area for most of her life and is a graduate of Gettysburg College with a B.A. in Business Management with concentrations in Accounting/Finance and Entrepreneurship. After graduating from college, she worked as a senior accountant for a large regional public accounting firm for 6 years. Lynne then worked as the controller for a water company for 9 years and also did accounting work for companies as a subcontractor until she began homeschooling her 3 children 14 years ago. In addition to homeschooling her youngest child, Lynne is the varsity girls volleyball coach at Tunkhannock Area High School and enjoys spending time with her family, playing volleyball, and volunteering at her church. Lynne is a recipient of two cochlear implants and is very grateful for the gift of hearing!

Christina Kaleta - Office Manager

Christina has over 25 years experience in the customer service industry. She has worked for large corporations, as well as small businesses. Prior to starting with Stone House, she had worked for a local insurance company for over 18 years maintaining customer service and lasting relationships with clients. She is dedicated to providing an excellent client experience within our Medicare office. Christina currently lives in Tunkhannock with her husband Eric, daughter Abby who is a college student at University at Albany, her son Matthew who is a student at Tunkhannock Area school district, and two dogs Riley and Milo. In her spare time, Christina enjoys cooking, watching her son play baseball, and spending time with family and friends.

Samantha Hayward - Business and Municipal Consultant

Lynne Binner - Business and Municipal Consultant

Stone House Tax, Business and Municipal Accounting

Tunkhannock Office

Jennifer Smith-Crary

Business and Tax Consultant

Diana Patton

Business and Municipal Consultant

QuickBooks Certified ProAdvisorIntuit Certified Bookkeeping Professional

Samantha Hayward

Business and Municipal Consultant

QuickBooks Certified ProAdvisor

Intuit Certified Bookkeeping Professional

Lynne Binner

Business and Municipal Consultant

Christina Kaleta

Office Manager

Towanda Office

Ben DeNault, CPA

Accounting Consultant

Kasey Elliot

Senior Accounting Assistant

Amanda Weinman

Accounting Assistant

Stone House Medicare Insurance Advisors

Stephanie Holdt

Medicare Insurance Advisor

A GREAT PLACE TO START!

The Retire From School 4- Part Video Series

Designed for PA Public School Employees planning for retirement in the next 1-5 years, this 4-part Retirement Video Series will help you make the transition into retirement with ease and peace of mind.

The 4 Parts of the PSERS Video Series

Part 1: What to Expect

In Part 1 of the PSERS Video Series, you'll find out what to hand on-hand to make the most of this learning experience. We'll also offer additional resources to keep you on-track with retirement planning.

Part 2: The Parts of Your Plan

In Part 2 of the PSERS Video Series, you'll get a birds eye view of the parts of your PSERS plan.

- Your PSERS Pension Options

- Your 403b Account

- Your Sick, Vacation, and Incentive Pay

-

Your Retirement Income Plan

Part 3: How to Make Your PSERS Retirement Last 30+ Years

In Part 3 of the PSERS Video Series, you'll learn how to make your PSERS Retirement Last 30+ years with the use of a comprehensive retirement income plan.

Part 4: A Helpful PSERS Case Study

In Part 4 of the PSERS Video Series, you'll get to watch two Stone House Advisors review a retirement income plan created for a PSERS retiree and her spouse. We aim to give you a concrete example of what goes into a retirement income plan so you can begin making sense of your own retirement income numbers.

How We Test Your Plan

- Understand how to design a solid plan based on your assets, incomes, expenses, and social security.

-

Create different versions of how you might live in retirement.

-

Test your plan against many different market environments.

-

Choose the version of your retirement that fits your needs and has the highest probability of success.

Retirement Income Planning

- Understand your 401K and Employee Stock Ownership Plan (ESOP).

- Avoiding the tax penalty for early distributions.

- The potential impact of Required Minimum Distributions (RMD)

-

Preserve retirement accounts for your spouse and beneficiaries and protect it from inflation.

How to Avoid Costly Mistakes

- Tax strategies that can save you thousands,

- Build flexibility in your distributions so you don't get hit with penalties.

- Learn the most likely things to kill your retirement and how to avoid them.

-

Know why health care is such an important (and often overlooked) cost to consider in your plan.

Frequently Asked Questions

Do I have to be retiring this year to get the most out of the PSERS Video Series?

The PSERS Video Series is designed to be most helpful for those preparing for retirement in the next 1 to 5 years from the PA Public School System.

I'm planning for retirement from the PA Public School System, but my spouse is not. Will the video series still help us?

Yes! In fact, in Part 4 of the PSERS Video Series, we'll show you a case study of a couple like this—one is retiring from the PA Public School System soon, while the other owns a small business and isn't sure of when they'll retire.

Am I obligated to work with Stone House Retirement Income Planners after I sign up for the PSERS Video Series?

Not at all. You may sign up for and go through the PSERS Video Series, provided by Stone House Retirement Income Planners, and then choose to manage your own retirement income plan or work with a financial advisor of your choice.

Does this video series cost anything?

No. This video series is completely FREE. All we need to deliver it is your email address.

Want to Sign Up for the Free PSERS Video Series?

LEARN IN-PERSON

PSERS Live Seminars

Our team of Stone House Advisors will be hosting a live seminar near you! If you prefer to meet in-person to learn more about your pension options and how to develop a retirement income plan, sign up for a PSERS Live Seminar this Fall!

Tunkhannock

80 West Tioga Street

Tunkhannock, PA 18657

Sayre

107 S Elmer Ave

Sayre, PA 18840

Towanda

319 Main Street

Towanda, PA 18848

Join Stone House Advisors as they lead a FREE presentation for Cape Girardeau employees on how to build a custom and reliable retirement plan after leaving P&G. Get answers to your questions. In this seminar, we'll cover:

COVID-19 Operations Update: Don't worry! We've got you covered. We are ready to help through the phone, mail, and internet - Read More.

Not able to attend a live event? We have a recorded seminar ready to watch at your convenience. Click the button below to sign up and receive a copy of our seminar!

Already a Client? Login Here.

Interested in learning more? Watch Kirk's recorded webinar about P&G Retirement to kickstart your planning.

"Ever since our first meeting, Kirk has been a rockstar."

- JACK BLACK

"I do not like retirements unplanned. I do not like them."

- SAM I AM

"Retirement rade reasy."

- SCOOBY DOO

Meet With Us From The Comfort And Safety Of Your Home

Getting the right retirement solutions has never been easier. Just give us a call or meet us on Zoom.

We Can Meet With You In A Video Conference, Share Our Screen With You, And Even Help You Do Things On Your Computer.

Stone House Meet is a super simple video meeting solution. You can join one of video meetings on your smart phone, tablet or computer right from your home!

Learn More about Chad through His Stone House Story.

I've been blessed in life to be surrounded by people who have supported me. From a young age, I had the support of my parents as I tested out entrepreneurship with a lawn mowing business. Rather than spend my money on toys and candy, my Dad taught me how to invest and grow my earnings and it sparked a life-long love of the stock market, business, and investing.

In college, I used an athletic and academic scholarship to graduate debt free from college. It was not easy to play football and graduate in 5 years with a Bachelor's Degree in Chemical Engineering and a Master's Degree in Engineering Management, but it paid off when I was hired by Procter & Gamble in 2004. I began my career making diapers at the plant in Cape Girardeau, Missouri, eventually making my home in Cincinnati, Ohio.

While P&G has been great to me over the years, I still find myself daydreaming about helping people with their financial planning, leveraging all the lessons my Dad taught me as we invested my lawn mowing money so long ago. After years of daydreaming, my wife, a brilliant and successful marketer, finally convinced me to pursue my passion and supported me in becoming a financial adviser.

After researching several firms, nothing felt right. I needed a team that was really behind me; I wanted to truly help people make better financial choices, I wanted to have a hand in the portfolios I managed for clients, and I didn’t want to get paid through commissions for products I recommended to my clients.

One day I was talking to a friend of mine and he mentioned an investment advisory firm that works with a lot of Procter & Gamble employees and retirees. In fact, a partner of the firm, John Burke, had worked for P&G for over 15 years, spending his last 5 years doing financial advising part-time. I didn’t expect much when I sent an email to John at Stone House Retirement Income Planners. I figured he might respond, we might have a good chat, and that would probably be the end of it.

But it was just the beginning. John asked questions about me and about my life. He asked me about what I wanted and helped me understand my options for getting there. Over the next few weeks, it became clear that Stone House was a really great company with a passion for doing what is best for the client. When I first saw their LifeStack system, I knew I wanted to be a part of the Stone House team. Holistic financial planning - not just investing - can be overwhelming, and LifeStack makes it feel natural. I could tell it was developed by someone who had worked at P&G for a long time; like most P&G systems, it makes the complex simple and focuses on continuous improvement.

Fast forward to today...as a proud member of the Stone House team, I am now a financial advisor focused on retirement income planning. With their support, I've created a schedule that allows me to stay in my current role at P&G and after hours, I help people understand their benefits and retirement options.

With all the support I've been given over the years, I hope you'll give me the chance to support you, too. I'd love to "engineer" your ideal retirement.

Interested in setting up a time to talk? Please reach me by email, at CTaake@StoneHouseMail.com, or by phone, at (570) 836-7020 or 1 (866) 923-1946.

Can Your Retirement Last 30 Years?

Live Seminar Event

June 7th & 8th at 5:30pm

Broussards Cajun Cuisine

Disclosures:

Stone House nor its representatives are affiliated with or endorsed by Procter and Gamble, Cargill, or PSERS. P&G is a registered trade mark of Procter & Gamble.

Privacy Policy

Registration with the Securities and Exchange Commission does not imply that Stone House or its representatives have achieved a certain level of skill, certification or training or that the SEC approves of Stone House or its services.

No services will be performed prior to the delivery of our Form ADV 2, which is the disclosure document that outlines our business activities, fees and conflicts of interest. This is not a solicitation of service in any jurisdiction in which the Investment Advisor is not registered or is not exempt from registration. Please call for additional information if interested in learning more about our company and services.

Investments are not risk free and should be considered carefully by the client before investing in our strategies. Securities may lose value. See prospectuses and other disclosure documents for details of risks. Past performance is not an indication of future performance. Stone House® Investment Management, LLC does not guarantee the performance of any strategy or portfolio.

Information on this website does not involve the rendering of personalized investment advice but is limited to the dissemination of general information on products and services. All expressions of opinion reflect the judgment of Stone House® Investment Management, LLC as of the date of publication and are subject to change.

Fees listed on this site only represent fees charged by Stone House for services provided. Additional fees may be applied by third-parties depending on the services rendered. See ADV 2 for details.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.

Wealth Management Specialist ℠ and WMS ℠ designations are issued by the College for Financial Planning® And are subject to established standards of conduct.

You can verify designee status at http://cffpdesignations.com or call 800-237-9990.

This website is a publication of Stone House® Investment Management, LLC. The information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of any subjects discussed.

Stone House®, Diversidex®, and LifeStack® are registered trademarks. All rights reserved.